Chapter 3 – The Ultimate Guide to Buying Pre-Construction Condos in Toronto

Why did we write this guide?

We want to be the number one source of information for pre-construction condominiums. Our team meets with hundreds of investors for new condos every year and there is one common statement that we hear time and time again; there is no one place to get all the information that you need to get started in investing in pre-construction condos. We want to be your one stop for information and give you the best access to the best new condo projects in Toronto.

Who is this guide for?

This guide is for anyone interested in pre-construction condominiums. We share details, tips and tricks about investing in Toronto that work for every level of condominium investor whether you’re just getting your feet wet, or even if you have purchased new condos in the past. We feel there is something for everyone.

How much of this guide should I read?

I would suggest reading it all. We have split this guide into three easy to understand sections:

- Chapter 1 – Why Pre-Construction and why Toronto?

- Chapter 2 – How to buy Pre-Construction (including the best tips and tricks to getting the best deals)

- Chapter 3 (This Chapter) – What Pre-Construction Condos to buy (because we know that not all condos are built equal, so it’s very important to put your money into the right project!)

CHAPTER 3 – Identifying the best Pre-Construction Condo Investments

There are dozens of new condo launches every year and it can be daunting to look at all the options and decide which projects you should invest in. The truth is that less than 5% of new condo launches are worthy investments and meet our criteria that we then take to our investors.

Identifying the best new condo project is hard, but easy. What we mean by that is that while it can be daunting, if you focus your efforts and use certain criteria then that large list of condo projects very quickly becomes very small.

That criteria is nothing groundbreaking, and just goes back to real estate 101 – the investment needs to be by a strong developer, in a great location and offer incredible value. Below is a quick venn diagram of how these three critical aspect of a new condo project interplay with each other.

The three keys to investing in a new condominium. It is important to have all three: A Great Developer, An Amazing Location and Incredible Value. Even if one is missing, you should think twice.

The three keys to investing in a new condominium. It is important to have all three: A Great Developer, An Amazing Location and Incredible Value. Even if one is missing, you should think twice.

DEVELOPER – Always buy from a reputable developer

It is understood that buying pre-construction means that you are buying a piece of paper with a promise to build what was marketed some time in the future. A big part of the risk of investing in pre-construction condominiums is trusting that the developer will deliver what they promise, when they promise.

More importantly, perhaps, a good developer will be by your side if there are issues that arise once the project is complete.

How do I know if the developer is reputable?

There is no single source that tells us if a developer is reputable or not. Platinum Agents tend to have inside knowledge about which developers are reputable in the industry and which are not. There are a handful of useful resources out there that a buyer can look at including:

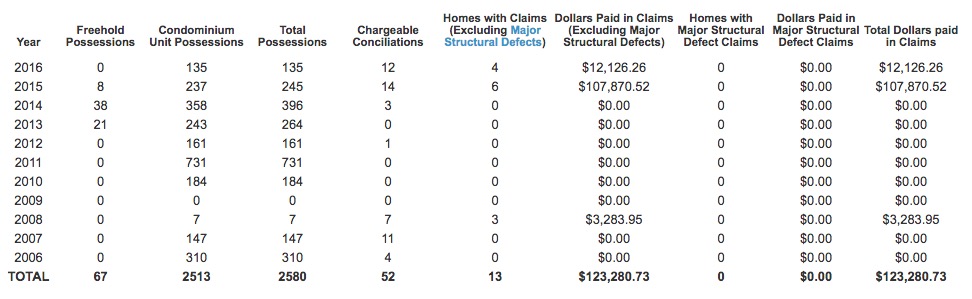

- TARION: Tarion is the third party warranty corporation that every developer answers to. They oversee any complaints and issues that buyers may have had with a builder in the past. You can search for the builder on their Ontario Builder Directory which highlights how many homes they have built in the last 10 years and whether they have had any claims with Tarion in the same period. TARION also have two annual awards: The Homeowners’ Choice Awards (voted by the homeowners) and the Tarion Awards of Excellence.

The above image shows the Tarion search for Urbancorp, a developer with a notoriously bad reputation that recently went bankrupt. A quick search on Tarion’s website should have sent up some red flags with a high number of chargeable conciliations and dollars paid in claims

- BILD: BILD is the Building Industry and Land Development Association. Every year they host the BILD Awards that honor the top developers in the year. This is a great way to see which developers are being rewarded by their peers.

Some examples of great condo developers are:

- Tridel

- Great Gulf Homes

- Canderel Residential

- Daniels Homes

- CentreCourt Developments

- Menkes

- Liberty Development

- Bazis International

- Plaza

Click to Get First Access to Toronto’s Best Condos Before the General Public

LOCATION – Always buy in a location with potential

Everyone knows the old real estate adage “location, location, location” and that rings true when investing in pre-construction. It is important to understand that when you purchase a condominium, you are investing in a lifestyle. If you understand that fundamental then it becomes much simpler to pick out what makes a great condominium location. When looking to identify a neighbourhood and condo developments potential, consider some of the following advice:

- TIP: Always check out the WalkScore and TransitScore. They give great insight into what is nearby the condominium

- Close to Jobs – many people are now looking to live closer to work and as a result it is important to focus on areas nearby major employment hubs including: Financial District, Hospitals, Universities

- Close to Universities – University students and faculty are a great source for rentals. Condominiums nearby Universities often give great monthly cash flow from a rental perspective and are very popular investment options

- Close to Transit – transit lines are becoming increasingly important. A located close to key transit lines (especially subways or streetcars) are very important for new condo projects

- Look for investments to make the neighbourhoods better – look where the Government and developers are investing to improve infrastructure (example, the newly proposed Downtown Relief Line Project in Toronto’s East End.Line), or to create brand new neighbourhoods (such as Regent Park, East Bayfront, Yonge & Eglinton, Vaughan Metropolitan Centre which are all undergoing huge change)

I want to invest in Toronto’s best neighbourhoods

VALUE – Always know your numbers

When you’re evaluating your new condo purchase, you need to evaluate three different pieces of the puzzle to make sure you’re getting the full picture.

- Analyze vs. other pre-construction condo projects available

- Analyze vs. resale condominiums in the area

- Analyze the rental market in the area

When a new condominium is complete, both resale pricing and rental rates tend to be stronger than the existing market as buyers and tenants want to be in the “newest” building in the neighbourhood. Investors are able to make great returns, especially when they compare the pre-construction condominiums to the resale market and are able to purchase BELOW the existing condos.

The Ultimate Pre-Construction Investing Blueprint

Buy at a discount compared to the existing resale condos

Sell at a premium to those same resale condos once completed

Analyze vs. other pre-construction condo projects available

The first step is to identify other condominium projects that any potential buyer might also look at. We are looking for three key pieces of information.

- Percentage sold for nearby projects – if other projects are holding a lot of inventory, this could be a bad sign or a red flag

- Price of available units

- Price of available units compared to subject property

I want to invest in new condos that will maximize my returns

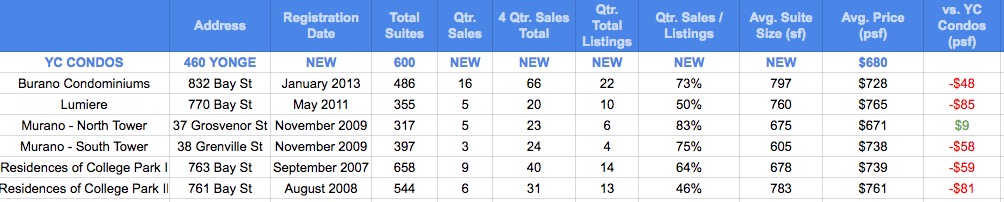

Below is a sample analysis that our team ran for YC Condos when the project launched in 2014. This project is now 100% sold out and will be one of the best investments of the last few years.

Compared to similar projects, YC Condos at the Platinum Launch was priced very favourably and ranged from $75-$189 per square foot cheaper than nearby projects with similar level of finishes. It was also important to note that the other projects sold very well, ranging from 83%-92% sold which tells us that we are dealing with a very in demand area. This was a great sign but still doesn’t tell us the entire picture.

Analyze vs. resale condos in the area

The next step is to take a look at how the pricing compares to the resale market. This is one of the most important pieces to analyze because it tells us what the actual market of buyers is paying to live in this neighbourhood TODAY.

Our team of analysts look at the nearby projects to get a clear sense of where the market is and compare those numbers to the subject condominium.

Again, in this example we see that YC Condos was priced below the current resale market despite offering a superior location (right at the corner of Yonge & College), better amenities (including a 66th floor amenity pool) and very efficient suite design.

Analyze the rental market in the area

Analyzing the rental market helps us determine an approximate rental rate so that we can run predictable cash flow analysis to calculate the yield on the monthly rents.

Once we determine a per square foot lease rate (we determined that $3.25 per square foot would be a conservative lease rate to assume upon completion of YC Condos) then it’s important to run the cash flow model using different mortgage assumptions to determine our cash flow ROI.