Buying Process – New Condo FAQ’s

What is Pre-Construction Condo Investing and Why is it so Popular?

Investing in Pre-Construction Condos refers buying a new condominium before it is built and is a very popular form of investing in the Greater Toronto Area.

Investing in pre-construction condos is popular for a variety of reasons including:

- Completely hands off investment that makes your money work for you

- Purchase with low deposits (usually between 15% to 20%) and no other payments for the duration of construction

- High leveraging of equity. Buying with just 20% down is a 5:1 leverage which means that for every percent that the condominium grows, your equity grows 5x

- New condos tend to trade at a premium over older condos on the resale market

- If you take advantage of the New Condo Launch Cycle (more on that below) you can save thousands when buying

Do all agents have the same access to New Condo Projects?

No.

Developers give agents access to their projects based on their

Agents are typically grouped based on their sales volume and are given access to condominium projects accordingly.

PLATINUM AGENTS – Typically 10-15 of the top agents in Toronto typically sell large volume of condominiums. Have the first and best access to the best condominiums in Toronto.

VIP AGENTS – Approximately 200-300 agents in Toronto. Typically have access to projects AFTER the Platinum Agents. Prices usually increase, incentives are removed and the best suites are often already sold.

TREB AGENTS – Project opens to the entire Toronto Real Estate Board of 30,000 agents. Project may already be 70-80% sold and prices increased significantly

Choosing the right agent with the right access is vital to pre-construction condominium investing.

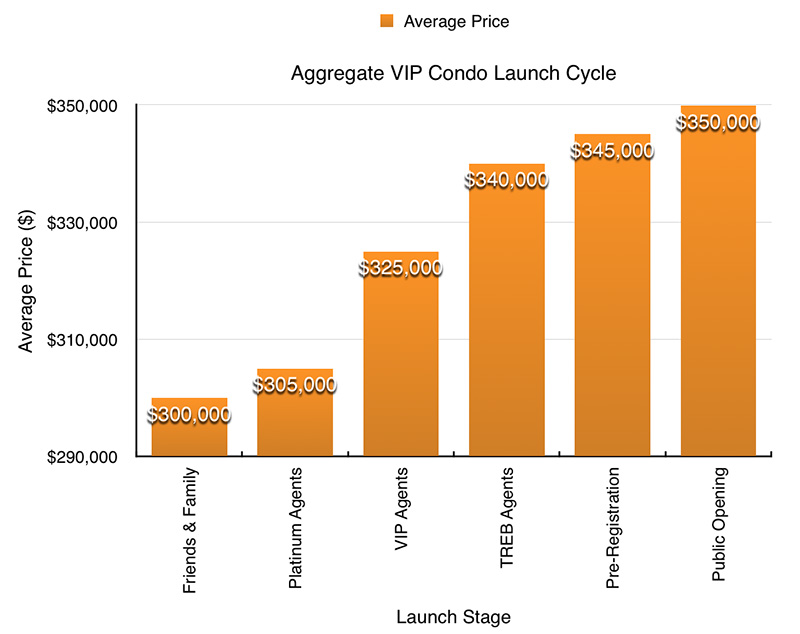

What are the stages of a New Condo Launch?

It is important to understand that every condo launch cycle will be slightly different. Not all condo launches will follow the same format, however, the below example is an aggregate of how a condo launch takes place in Toronto. As a developer goes through the stages, they will typically increase prices and remove various incentives.

Below is a graph to highlight the approximate prices as a developer goes through the stages of a condominium launch in Toronto. NOTE: The graph is for illustrative purposes only and do not reflect real life pricing.

For illustrative purposes only – Aggregate Launch Cycle for a New Condominium in Toronto

For illustrative purposes only – Aggregate Launch Cycle for a New Condominium in Toronto

STAGE 1 – FRIENDS & FAMILY

This stage is typically not advertised and is only available to close friends and relatives of the developers. There is not typically an “event” to purchase at this stage. Friends and family members will be invited to purchase before they start to sell.

STAGE 2 – PLATINUM LAUNCH

Platinum Agents are those that typically sell large volume of pre-construction condominiums. Platinum Agents are typically characterized as the following:

- They tend to specialize in pre-construction condominiums and do little to no resale

- They tend to work with large volume of investors

- They tend to sell 10+ units at major condominium projects

- There are only a handful of true “platinum agents” in Toronto

- The Platinum Launch is typically the best time for investors to purchase at a new condominium with the following perks:

- Day 1 pricing, typically much lower than the other stages of a condo launch

- Typically the best perks and incentives

- Best suite selection (the “prime units” are often sold during the platinum phase)

STAGE 3 – VIP LAUNCH

VIP Agents are those that sell pre-construction condominiums but not to the same volume as a Platinum Agent. They tend to also work in resale real estate. They will be invited to the second round of sales. Prices are typically increased, perks and incentives are removed and the best suites are usually already sold.

STAGE 4 – TREB AGENT LAUNCH

Developers will then open up their sales to any TREB agent who may have clients. At this time, a majority of the best suites have already been sold and prices have been increased significantly.

Perks may be added at this time, however, the price of the units are often much higher than the perks being offered.

STAGE 5 – PRE-REGISTRATION INVITES

If you register on a developers website, you will get an invitation to be the first of the public buyers able to purchase. At this point you do not need an agent to purchase, however, prices have been increased, perks removed, many additional clauses may be added that will benefit the developer.

Even at this stage it is recommended that you have outside buyer representation to assist you through the process.

STAGE 6 – PUBLIC OPENING

The final stage of a condo launch is the public opening. By this time there have already been 5 groups before that have gotten the best suites, the best prices and the best perks. In Toronto, our very basic rule of thumb is “if you are able to walk into a sales office without an agent representation, you are way too late”.

You can read more about the tips and tricks to investing in Pre-Construction Condos (including a closer look at the launch cycle) in Chapter 2 of our Ultimate Guide to Buying Pre-Construction Condos

What is a Platinum Agent?

Platinum Agent is an industry term to describe agents who sell large volume of condominiums in Toronto. As a result, Platinum Agents typically have the best access to suites and prices in the best new condominium launches (think of platinum agent incentives as “bulk incentives” as it is expected that a platinum agent will sell 10+ suites in a building).

Platinum Agents are those that typically sell large volume of pre-construction condominiums. Platinum Agents are typically characterized as the following:

- They tend to specialize in pre-construction condominiums and do little to no resale

- They tend to work with large volume of investors

- They tend to sell 10+ units at major condominium projects

- There are only a handful of true “platinum agents” in Toronto

The benefits of working with a Platinum Agent are:

- Best access to new projects, suites and the best prices (think of it as receiving “bulk pricing” from the developer)

- Insider knowledge of the project. Platinum agents typically meet with the developers months in advance of a project launch and may have behind the scenes knowledge that you would otherwise not have access to

- Excellent relations with developers in case any major issues should arise

What is the process to Purchase at the beginning of a new condominium launch with a Platinum Agent?

Below are the (typical) steps involved in purchasing a suite at the beginning of a new condo launch. The major difference between purchasing with a Platinum Agent is that (typically) there will be no lining up or scrapping for suites. Platinum Agents typically offer front of line access to the best projects and suites.

1 – Selecting the Project

Perhaps one of the most important aspects is selecting the right project. This will involve consultations with your real estate professional.

2 – Selecting the Suite

Once you choose the project, narrowing down your selection for the best suite. This will include a floor plan analysis, view analysis, individual suite price analysis and how the suites fit in your budget.

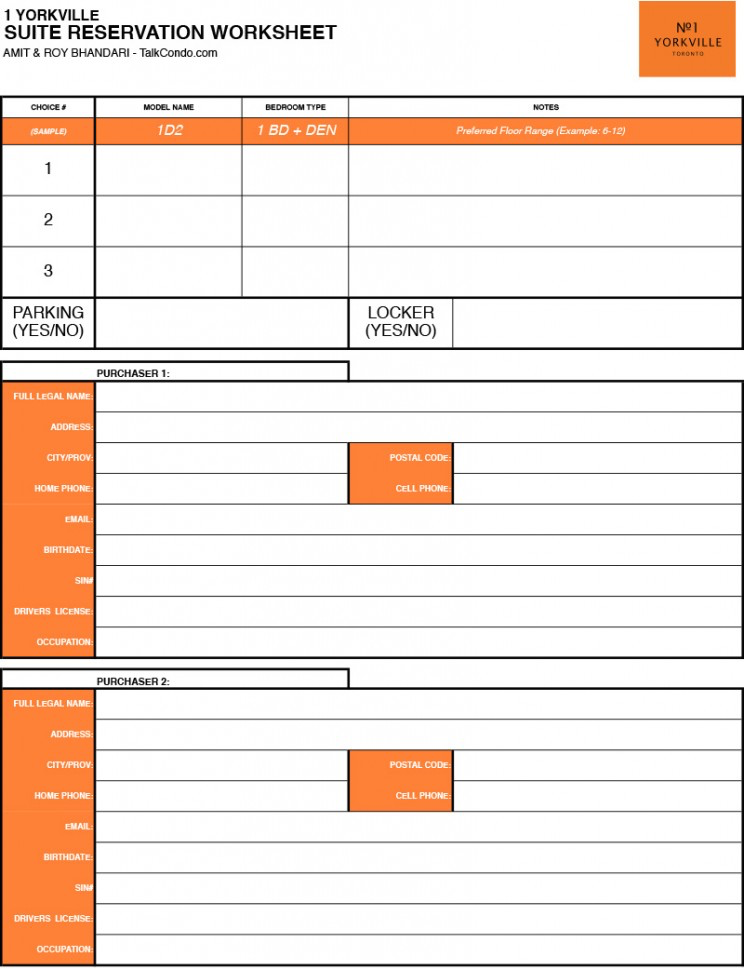

3 – Submitting a Suite Reservation Worksheet

Once you determine which suite you are interested in purchasing simply complete a suite reservation worksheet and return it to your platinum condo agent. The worksheet will outline the suite you are interested in and your contact information.

Your agent may ask for a copy of your ID to confirm that the information on the worksheet is accurate.

Below is an image of a typical suite reservation form.

It is important to note that by submitting a “Condo Worksheet” you are NOT binding yourself to purchase a suite. Once you have been allocated a suite you still have the option to change your decision. Once you sign the agreement, you still have the 10 Day Rescission Period to confirm your purchase.

4 – Confirmation of Suite Allocation

Your platinum agent will confirm the suite that has been allocated to you. Once you confirm that you wish to purchase the suite, you will make an appointment to sign the agreement. The suite will be on hold for you until that time.

5 – Signing the Agreement

Provided the information you provided on your worksheet is accurate, the paperwork for the agreement will be prepared before you arrive.

You will typically sign multiple copies of the same agreement so all parties have a copy.

6 – 10 Day Rescission Period

Once you sign the agreement, you will have a 10 day cooling off period. We recommend that you do the following during the period:

- Have a Lawyer review your agreement – a lawyer will read through the agreement and highlight any issues that may be of concern.

- Get pre-approved by a mortgage broker

If there are any problems within the 10 days, you will be able to cancel the agreement with no penalty.

7 – Deal goes firm & Deposits Cashed

On the 11th day, the deal will automatically go firm and the first deposit cheque will be cashed.

Understanding Market Appreciation and Platinum Price Appreciation

Market appreciation occurs through the natural growth of the market place and is typically measured at a macro level by looking at the average or median sale prices in a given area.

For the purposes of Pre Construction Condo investing, looking at the average price is not a strong indicator of value, therefore, we look at average prices within specific neighbourhoods and sometimes even within specific buildings in order to determine whether a project is well priced or not.

Platinum Price Appreciation is one of Toronto’s condo market secrets. By purchasing early in a condominium launch, investors will benefit from both market appreciation and platinum price appreciation which is achieved when developers increase the prices throughout the condominium launch.

Understanding Short Term/Medium Term/Long Term investing

SHORT TERM INVESTOR:

Definition: Typically referred to as a “flipper” with the goal of selling as soon as possible. Investment time frame is typically 0-5 Years.

Best Type of Projects: Typically in already established neighbourhoods with clear history of appreciation.

Key Incentives: Assignment Clause (able to sell before closing), Capping of Development Levies (to ensure that the assignment buyer is protected), Low deposit structures

MEDIUM TERM INVESTOR:

Definition: Medium term investors buy pre-construction condominiums with the intention of closing on the unit and renting it out for 2-4 years before selling. We find approximately 90% of our investors consider themselves “medium term investors”. Typical time frame from initial investment is 5-10 years.

Best Type of Projects: Established neighbourhoods with history of appreciation and rental rates, up and coming neighbourhoods with master plans that offer significant growth within 10 years, locations with emerging key features that will be completed within 10 years that will enhance the value of the condominium (example: new transit line, new park etc.)

Key Incentives: Capping of Development Levies, Rental Guarantees

LONG TERM INVESTOR:

Definition: Long term investors are building a portfolio of condominium suites as a form of wealth preservation. Long term investors will close on the unit and rent the suites with no definite timeframe to sell the units.

Best Type of Projects: Established neighbourhoods with history of appreciation and rental rates, up and coming neighbourhoods with master plans that offer significant growth within 10 years, locations with emerging key features that will be completed within 10 years that will enhance the value of the condominium (example: new transit line, new park etc.)

Key Incentives: Capping of Development Levies, Rental Guarantees

What is an Assignment?

An Assignment is when you sell your condominium investment before you take possession.

The time between when you purchase your condominium and when you take possession can range from 1-6 years depending on a number of variables (size and scope of project, how late in the cycle you purchased etc.). Until the possession date, there is no actual “ownership” of the condominium, therefore you are simply “assigning” the rights to the condominium to a new purchaser.. Many pre-construction condominiums offer an assignment clause for a small administration fee.

The benefits of an assignment are:

- Sell before you close

- No need to get a mortgage

- Potential to get original deposits and profits and “cash out”

The drawbacks of an assignment are:

- Most developers do not allow you to post your assignment listings on MLS, making it trickier to market and find potential buyers.

- No two assignment deals are ever the same which increases the complexity of the deal

- If the new buyer is unable to close on the condominium for whatever reason, the original purchase remains responsible to close.

What are development charges or development levies?

Development levies are government charges (essentially a “tax”) that can be charged to the development of a condominium as a closing cost. The levies are used to fund growth-related capital costs such as:

- Childcare

- Fire Facilities

- Shelters & Housing

- Police

- Emergency Medical Services

- Roads

- Sanitary Sewers

For example, when a new 50 storey tower is built – the additional pipes, trees, schools etc. that need to be built to support the new towers are taxed based on the impact of the building. The developer, in turn, is able to pass those costs on to the buyer and development levy fees have been as little as $50 and as high as $25,000 per suite.

One of the most important clauses in your agreement will be to “cap” those levy charges so that they don’t spiral out of control. If for example, you levies are capped at $5,000 and the levy charge is $25,000 – then you only pay $5,000 and the developer pays the additional $20,000.

What are Occupancy Fees?

The occupancy period is the time between when you get you take occupancy of your suite and when final closing occurs. Occupancy Fees can also be referred to as:

- Interim Occupancy Fees

- Phantom Rent

Assume a 60 storey condominium. The developer will build the outside shell first and then begin completing the suites from ground up.

If you purchased on floor 1, as soon as your unit is complete the developer will give you the keys and “occupancy” will begin. You don’t OWN the unit yet but you OCCUPY it. This process goes until approximately 75% of the building is OCCUPIED (in the example of the 60 storey condominium, that means once the suites on the 40th floor are complete) the developer will apply for condominium registration with the city and that is when final closing occurs.

During this period, the buyer is paying an “occupancy fee” which is essentially a rent on the unit until final closing. The occupancy fee includes three fees which are:

- Maintenance Fees

- Property Taxes

- Interest on Balance Owed (typically 80% but can vary depending on your deposit structure)

Occupancy time frames vary depend on the size of the building.

How much money do I need to invest in Pre-Construction Condominiums?

One of the greatest aspects of investing in pre-construction condominiums is that developers only require a total of 20% down until the condominium is completed.

To purchase a condominium at $300,000, your investment is just $60,000 (20%). For a condominium that is $350,000, your investment is $70,000 (and so forth).

From an investment stand point, it means that for every dollar that you put towards the condominium, the developer is putting in $4. It means that you essentially have an 80% interest free loan from the developer for the duration of construction.

Do I have to come up with the deposit all at the same time?

No.

Every condominium project will have a unique “deposit structure” but typically the 20% deposit is payable over 1 year in 4x 5% payments.

Sample Deposit Structure as seen on a price sheet

Sample Deposit Structure as seen on a price sheet

The table below highlights a typical deposit structure and is broken down in terms of percent of purchase price, and an example with an assumed $300,000 purchase price.

|

% Payable |

$ Payable |

|

| At Signing | $5,000 | $5,000 |

| 30 Days | Balance to 5% | $10,000 |

| 120 Days | 5% | $15,000 |

| 180 Days | 5% | $15,000 |

| 365 Days | 5% | $15,000 |

| TOTAL | 20% | $60,000 |

Understanding Incentives: Free Maintenance Fees for x Months

A free maintenance fee for “x” months (typically 12 or 24 months) is typically offered as a bulk payment on closing as a cash back (as opposed to a monthly credit).

For example – free maintenance fees for 24 months on a 700 square foot suite with maintenance fees of $0.50 per square foot would equal an $8,400 credit on closing.

700 x 0.5 = $350 per month

$350 x 24 = $8,400

Understanding Incentives: Rental Guarantees

Rental Guarantees have become one of the most popular incentives offered by a developer for new condominiums. Investors love them because they offer a safety net and a level of confidence in a project. Below are some frequently asked questions surrounding Rental Guarantees.

How Does it Work?

- When you sign your agreement, you will have a “guaranteed rental” amount per month typically for 1 or 2 years (depending on the development)

- The rental amount is pre-determined and typically calculated at “tomorrow’s rental amount” by using expected rental appreciation rates

- The developer essentially becomes your tenant and they “sub-lease” the unit and are responsible for finding a tenant for you

What if the Rental Market Is Significantly Different in the Future?

- IF the rental market dictates that you can actually command more rent for your suite than previously agreed, you are able to (typically) “opt out” of the rental agreement and rent it on the open market

- IF the rental market slows down or the developer is unable to sub-lease your suite, then you are still guaranteed the rent as outlined in the agreement

(think of the rental guarantee as a safety net that has the odds stacked in the investors favour!)

What are the Major Benefits to an Investor?

- It shows enormous confidence in a project by the developer

- It shows enormous confidence in the rental market in Toronto

- No Vacancy

- Investors save on Commissions charged for rentals

- Investors able to calculate their exact rental income with no vacancy for the duration of the rental guarantee (typically 1-2 years)

- For projects with 2 year rental guarantee, gives investors a built in mid-term investment strategy of renting the suite out for two years before selling

- Rental amounts are typically based on future rental amounts

What Are Some Examples?

The rental guarantee amounts also paint a picture of where the developers believe rental amounts will be in the future. The current rental rate (per square foot) downtown is approximately $3.00 per square foot (for example, a 500 sq.ft. suite at $3.00 per square foot would rent for $1,500 per month).

The chart below shows some examples of the amounts that developers are offering for rental guarantees. The chart highlights just how bullish the developers are on the rental market downtown and serve as a reminder to our ever growing market and the strength of the marketplace as an investment opportunity.

| TYPE | SQ.FT. | LOCATION | GUARANTEED RENT | RENT PER SQ.FT. | CLOSING |

| Studio | 310 | Ent. District | $1,800 | $5.80 | 2105 |

| Studio | 313 | Core | $1,450 | $4.62 | 2017 |

| 1 Bed | 495 | Yorkville | $2,000 | $4.04 | 2017 |

| 1 Bed + Den | 462 | Core | $2,000 | $4.32 | 2017 |

| 2 Bed | 742 | Core | $3,000 | $4.04 | 2017 |

Understanding Incentives: Cash Backs

Cash backs are offered as an additional discount on top of the purchase price and will be adjusted on closing.

For Cash Backs, it is important to note that the deposits you pay will be based on the full purchase price BEFORE the cash backs. Example: If you have purchased a suite for $300,000 with a cash back of $20,000, you will pay the deposit (typically 20%) on $300,000 and not $280,000.

What is the Best Project to Buy?

There is no blanket answer for everyone and the “best” projects will all depend on the individual investment goals and budgets.

When analyzing a project we look at a variety of different items that fall under four main points: Location, Project, Developer and Value.

We find the best condominiums for investment purposes tend to score high on three key categories: Location, Developer and Value

LOCATION:

- Access to Transit (TransitScore)

- Access to Amenities

- Walkability (WalkScore)

- Location Future Plans

PROJECT:

- USP (Unique Selling Proposition) & Unique Features

- Stage of Launch

- Floorplans

- Demographics of Buyers/Renters

- Investor vs. End User

- Amenities

- Features & Finishes

DEVELOPER:

- History & Track Record

- Reputation

VALUE:

- Market Value (Comparative Analysis)

- Rentability & Rental Demand

- Appreciation Analysis

- ROI & Cash Flow Analysis

- Deposit Structure

- Purchase Incentives

We carefully analyze condominium projects under the above points to determine which condominiums stand out from the crowd.

We discuss more about how to pick the best new condo projects in Chapter 3 of the Ultimate Guide to Investing in Condos

When is the best time to buy a pre-construction condo?

Timing is vitally important when purchasing a pre-construction condominium. Typically speaking there are two “best times” to buy at a new condo project during the condominium sales life cycle.

1. At the Platinum Launch

Developers understand that there is the most opportunity for sales at the Platinum Launch. This is when the development has the most “hype” within the investment community and developers will offer the best prices, incentives and selection of suites.

2. Inventory Sale when the Developer is 60-70% sold

Developers are required to pre-sell approximately 75% before they get financing to develop. Sometimes a developer has sold (for example) 60% and are struggling to make up the last 15% of sales so that they can start construction.

At this time, a developer may do a special one day sale where they offer incredible incentives so that they can start construction and make the money back by increasing prices on the final batch of units once construction has already began.

These types of inventory sales are rare but they do happen. Many of the “top projects” will have no problem reaching 75% in sales, so these types of promotions may not happen at the AAA condo projects. These types of sales are typically not advertised in the public but are advertised through Platinum Agents who have special access so it is important to be working with agents who have access to these types of promotions.

NOTE: It is important to remember that every condominium is different. The above advice is based on typical pre-construction condominium cycles.

We detail the best times to buy a new condominium as well as other tips and tricks in Chapter 2 of our Ultimate Guide to Buying Pre-Construction Condos in Toronto.

Can I get better deals if I buy Multiple Units in One Project?

Typically speaking – no. However, every situation is different and open to negotiation depending on your buying power.

With increasingly stricter lending rules enforced on the developers, many developers only allow one purchase to purchase one suite with a typical deposit structure (20% down for a local purchaser). Additional suites may require more down payment.